6 AI Startups That Raised $1B+ in Q1 2025

$66.3 billion in fresh capital!

In Q1, capital pooled at the very top. Six AI (and AI-adjacent)1 startups raised more than $66 billion.

Below, I break down these mega AI deals, their investors, and some macro signals. First, let’s look at two quick charts to get a sense of the massive capital concentration.

Funding Concentration at a Glance

You already know who the usual suspects of billion dollar fundraising include—OpenAI, Databricks2, Anthropic.

What you may not know is that six startups absorbed $66.3 billion in fresh capital last quarter.

That’s almost 64% of all global core and adjacent AI funding I tracked for Q1 (≈ $103.88 billion across approximately 1,250 deals).

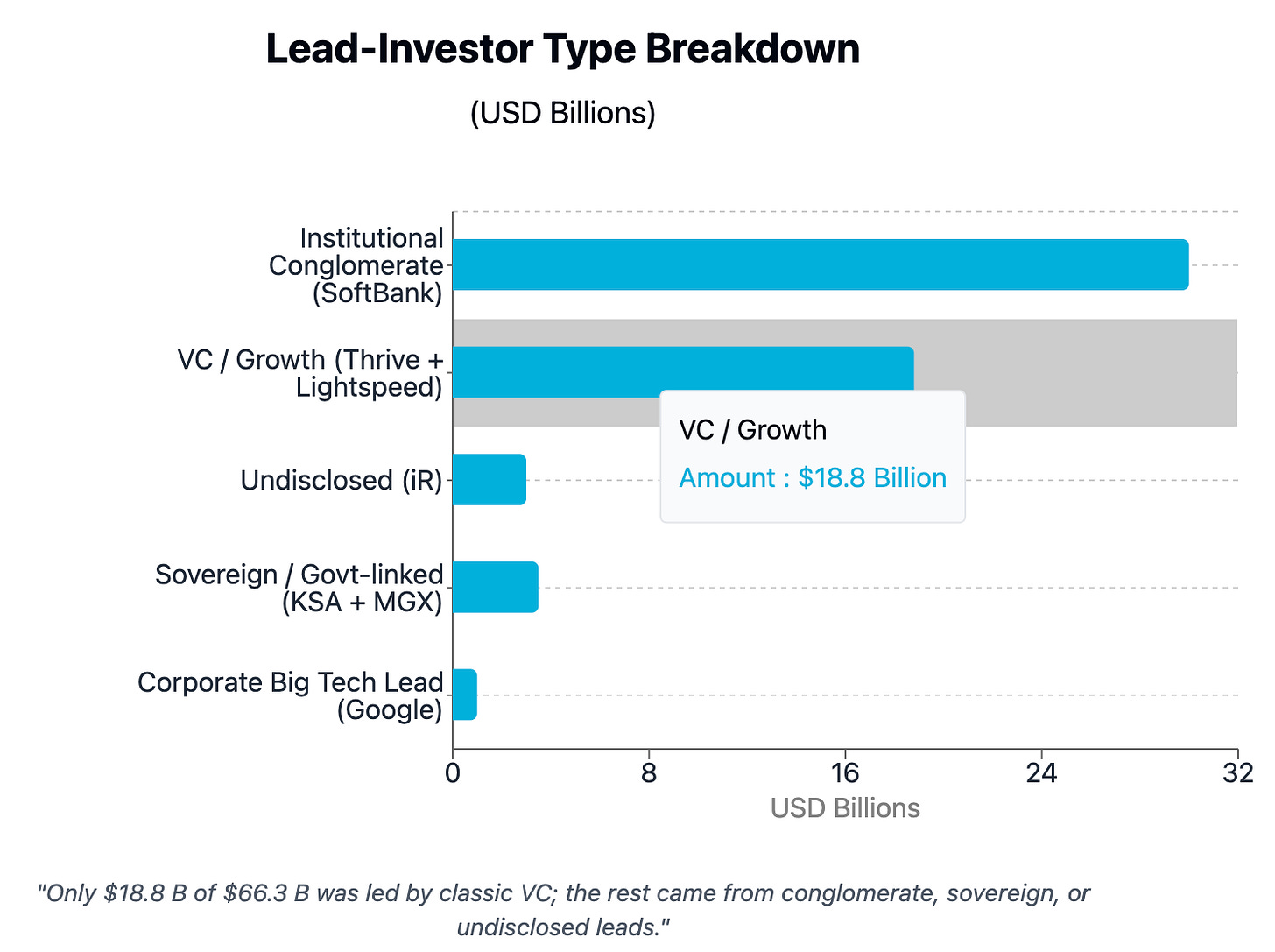

Traditional VCs Aren’t Leading AI Investments

Non-VC money leads most mega-rounds in AI. Continuing last year’s trend, Big Tech balance sheets and sovereign cash are heavily involved.

The Billion-Dollar Club: Q1 2025

Here are the details of the seven billion-dollar rounds in AI and AI adjacent sectors from Q1:

†We have some evidence from Google’s earnings release that they invested in Anthropic. But this $1 billion ticket for Anthropic by Google is unconfirmed by either party. It’s separate from the March Series E, giving Anthropic two billion-dollar rounds in a single quarter.

Three Macro Signals

Toll-booth economics still fetch mega deals: Startups enabling AI infrastructure—models, compute access, and training capacity—continue to command the largest funding rounds and valuations.

Strategic Investors Crowd Out Classic Growth VC: Corporate balance sheets (Google, Microsoft, Meta) and sovereign funds (KSA, MGX) are edging traditional growth-stage VCs out of lead positions.

The U.S. Remains the Mega-Round Magnet: Excluding Binance (HQ Malta), all $1B+ AI deals this quarter closed on U.S. soil, reinforcing America's AI dominance. Talent, IP, and funding are all concentrated in the US.

Final Thoughts: Where’s the Application Layer?

Big Tech and sovereigns still pour billions into owning infrastructure and compute access. The arms race keeps intensifying. Until compute supply normalizes, picks-and-shovels will dominate late-stage funding.

Yet some of the fastest growing AI startups as Ollie from New Economies highlighted are specialized applications in autonomous coding, legal tech, outbound sales, and customer support.

If you’re building apps, speed to product-market-fit has never been more rewarded. You just can’t expect a SoftBank-sized check to get there (yet).

This post is part of a series breaking down Q1 AI funding. Next up: we’ll dive into the industries, sectors, and geographies where the next wave of application-layer winners will emerge. Stay tuned.

At Bot Memo, Startups are tagged into core AI or AI-adjacent industries & sectors (such as crypto and VR) based on how integral AI is to their tech stack.

Databricks initially announced its $10 billion Series J funding round in December 2024, but we are using its January completion date as the basis for its inclusion in Q1 2025.