Hey,

What do Databricks (92 investors), Anthropic (62), and Mistral AI (39) have in common?

Beyond their unicorn valuations, they were all built by Super Syndicates—massive, strategic coalitions of investors.

What seemed like the quiet playbook of the AI elite is actually the dominant strategy across the entire AI funding landscape.

For instance, the AI funding market threw another $1.5B on the board this week across 61 deals.

Guess what?

We had 716 unique investors, with an average of 11.7 investors per deal.

Let’s see this Super Syndicate playbook in action in last week's most surprising geographic winner.

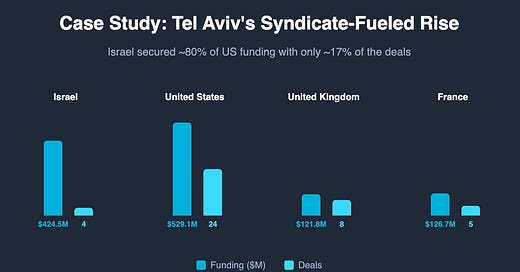

🌆 Case Study: Tel Aviv's Syndicate-Fueled Rise

Tel Aviv captured more funding than San Francisco last week.

It wasn’t a one-hit wonder either. It was a cluster of significant deals, led by Cato Networks and driven by large, multi-investor syndicates, that brought together a deep bench of enterprise and security experts.

The four deals totaled $424.5 million, accounting for 25.8% of all global AI funding.

For context: The entire US captured 39.8% across 24 deals.

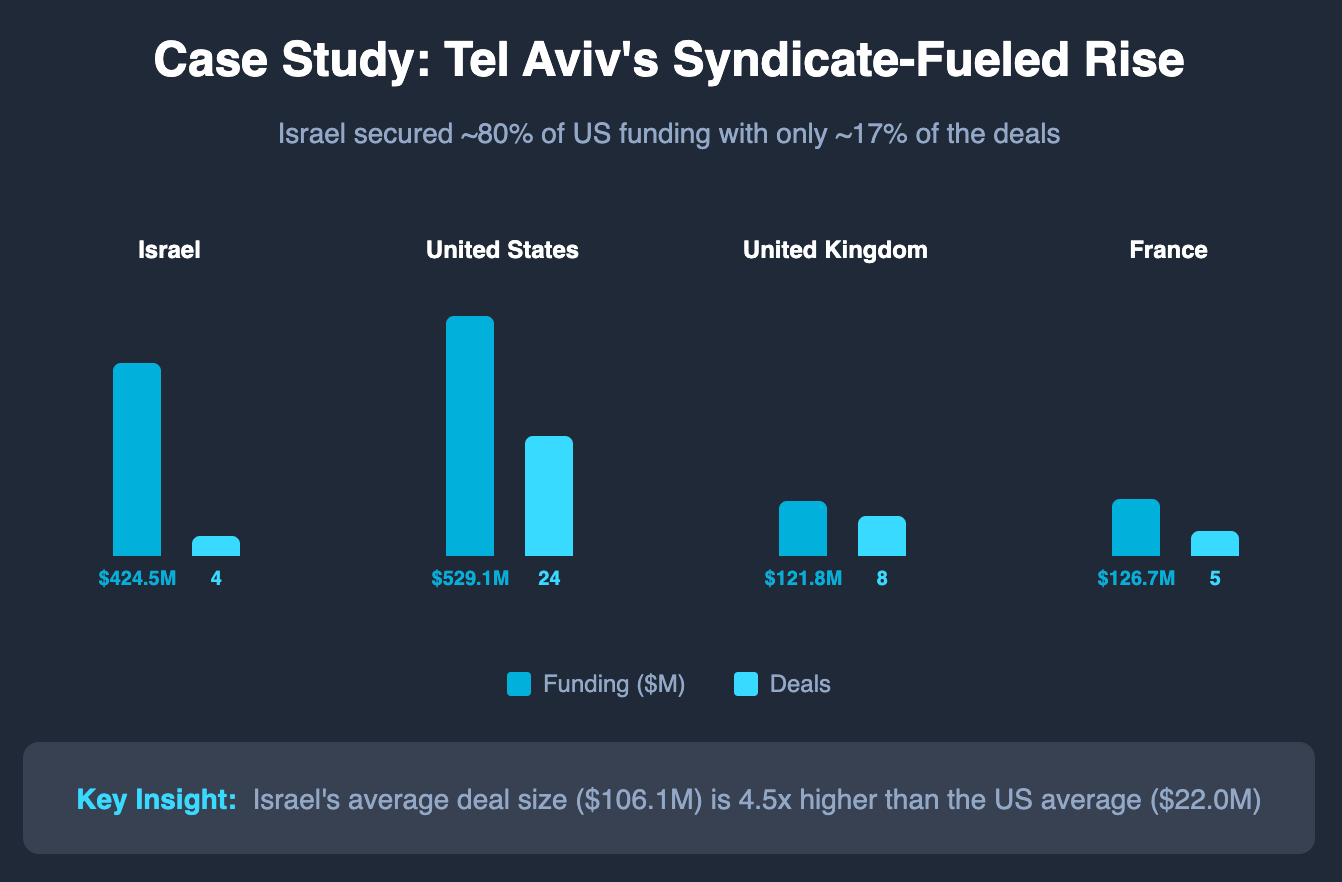

🧩 The Complexity Tax: Why It Takes a Village

So, why are cap tables getting so crowded? Because the problems AI is solving are getting harder.

We're moving beyond general-purpose chatbots and into the gritty, complex infrastructure that will power the next wave of industry.

This week’s biggest deals weren't simple consumer plays; they were deep, technical challenges requiring a "village" of specialists to properly vet, fund, and scale.

Cato Networks ($359M): Is fusing AI with enterprise security. This requires funds that understand both cybersecurity moats and global SaaS sales.

Genesis AI ($105M): Is tackling universal robotics models. This needs a blend of deep-tech VCs, hardware specialists, and corporate partners who can deploy their robots in the real world.

SkyDrive ($56.6M): Is building flying vehicles. This required a syndicate of 11 different investors spanning finance, manufacturing, and transportation.

The more complex the problem, the more diverse the syndicate needs to be.

But this complexity tax isn't hitting all sectors equally. Some verticals are practically requiring super syndicates to even get deals done.

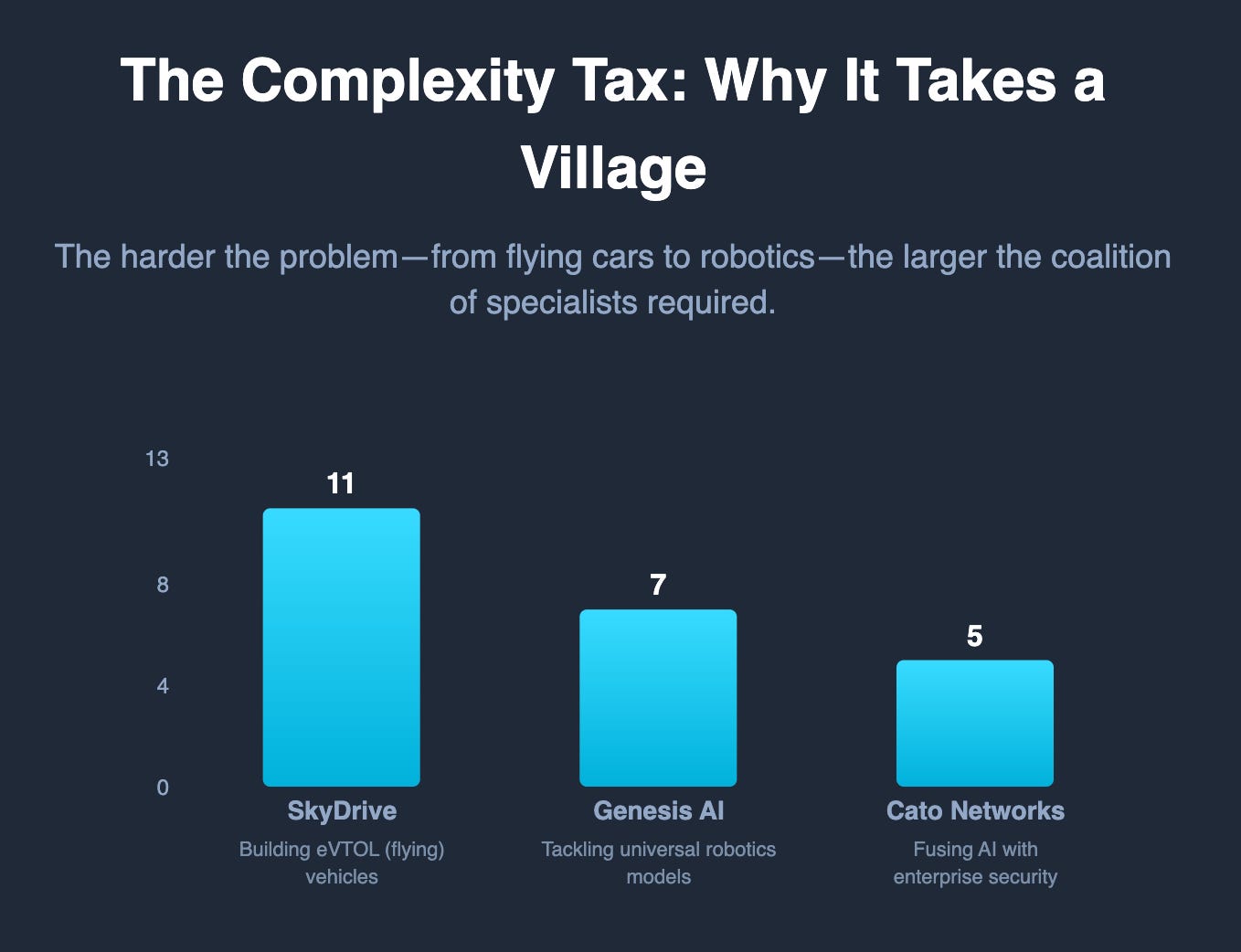

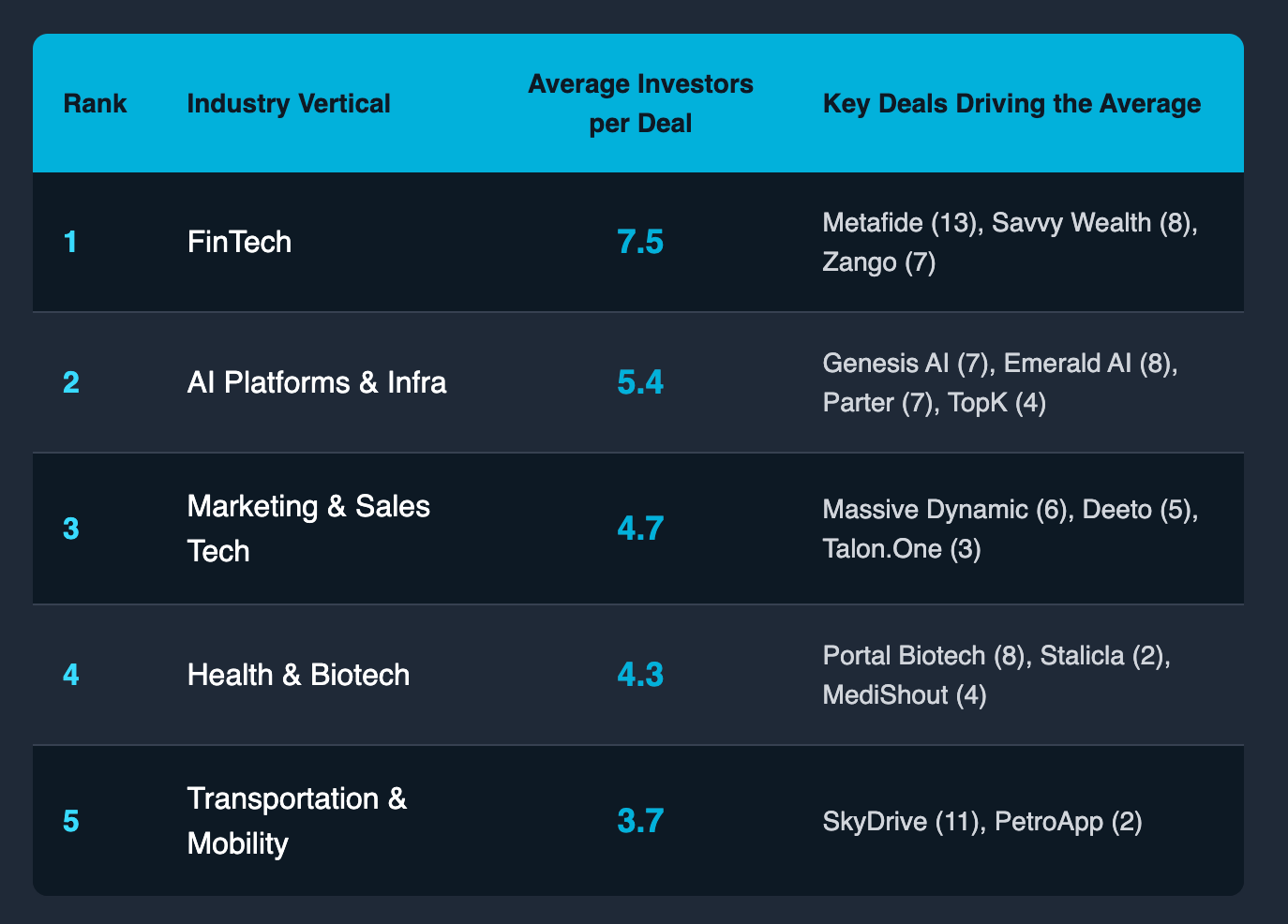

🥵 The Real Syndicate Hot Zones

The verticals that attract the largest average number of investors are those with the highest complexity, not just in technology, but in go-to-market strategy and regulation.

FinTech (Average: 7.5 Investors): The clear winner. To succeed in FinTech, startups need a coalition that can navigate global regulations, build trust, and forge partnerships with incumbent institutions. Deals like Metafide (13 investors) and Savvy Wealth (8) prove you need a village to manage financial complexity.

AI Platforms & Infrastructure (Average: 5.4 Investors): Consistently strong. Building foundational AI requires a true ecosystem—VCs for capital, cloud providers for compute, and corporate partners for distribution, as seen in deals for Genesis AI and Emerald AI.

Here’s a look at the analysis on the complete set of 61 deals:

So what does this Super Syndicate dominance mean for the broader AI ecosystem?

🔮 The New Rules of AI Funding

We're witnessing a fundamental shift in how AI companies get built and funded. Building a capital-intensive, category-defining AI company will probably require a syndicate.

This isn’t even about money. You need the right expertise to navigate regulatory hurdles (fintech), understand technical feasibility (robotics), and provide go-to-market channels (enterprise software).

What's your take on the Super Syndicate trend? Is it a smart strategy or a sign of a frothy market? Hit reply and let me know your thoughts.

My super syndicates are v v v real 🌟 thanks for sharing 🌞