I know. I know.

It’s been a while since I hit your inbox.

But pinky swear, I only got half addicted to creating Python scripts with Claude (okay maybe I spend like eight hours a day building them lately!)

Of course, these scripts are all a part of the Bot Memo workflow that would enable me to create super high-quality data analysis for you!

Today, let’s look at the top trends from 61 AI startups that I tracked raising above $50M in May.

In May, capital chased data moats (across insurance, wealth, real-time analytics) and mission-critical ops (defense, payments).

Here’s some quick takeaways:

$11.1B flowed across 15 sectors and 12 countries

Ten deals ≥ $250 M captured 55 % of all dollars

Investor appetite stayed strong—275+ unique VCs wrote checks

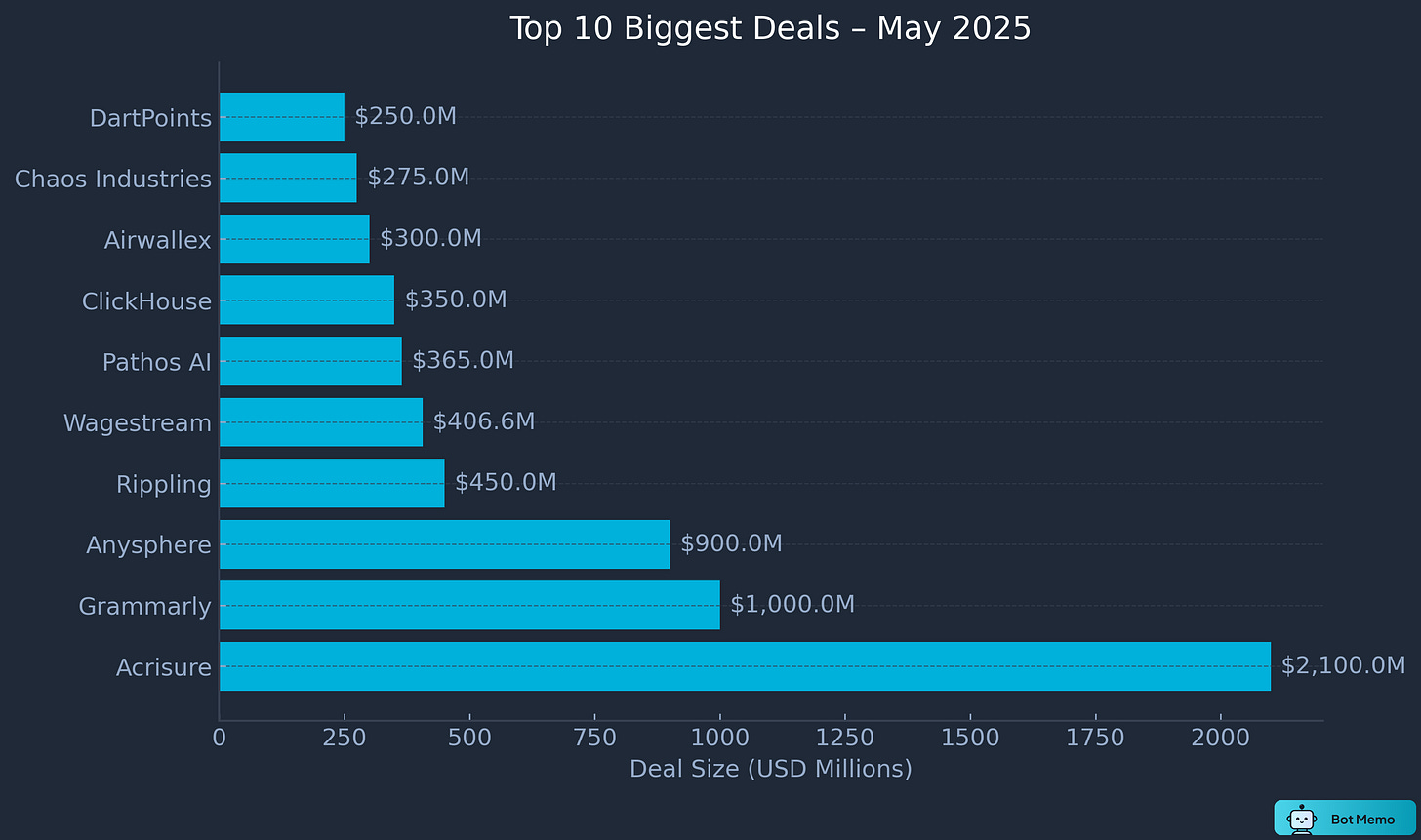

Let’s start with a spotlight on the biggest deals.

Spotlight on Top AI Deals From May 2025

Most top deals involve a company that owns or manages large, unique data sets. Top five tell us that story:

1. Acrisure: This insurance broker has evolved into a full “financial-services platform.” And with Bain’s large “preferred” equity package, it gets room to clean up its balance sheet. Their total valuation has jumped to about $32 billion (which is roughly 40 % higher than in 2022).

2. Grammarly (>$700M ARR): With 40M users, they're racing Microsoft Copilot by embedding agents across office workflows. They acquired Coda and are going after becoming a horizontal productivity layer.

3. Anysphere ($9.9B valuation): The parent company behind one of the most beloved “vibe coding” tools, Cursor, had already touched $500M in ARR in under three years. Raising its third round in under a year. When developers love your product this much, valuations get wild.

4. Pathos AI: Multimodal foundation models for oncology trials. Their PathOS platform blends omics, imaging, and real-world data to rank drug targets. AI healthcare companies paired with hard-to-replicate clinical data remain irresistible.

5. ClickHouse: With a big cash boost and an additional $100M credit line, the company can beef up its managed cloud offering. Competition with Snowflake and Databricks just got interesting as AI apps demand faster data answers.

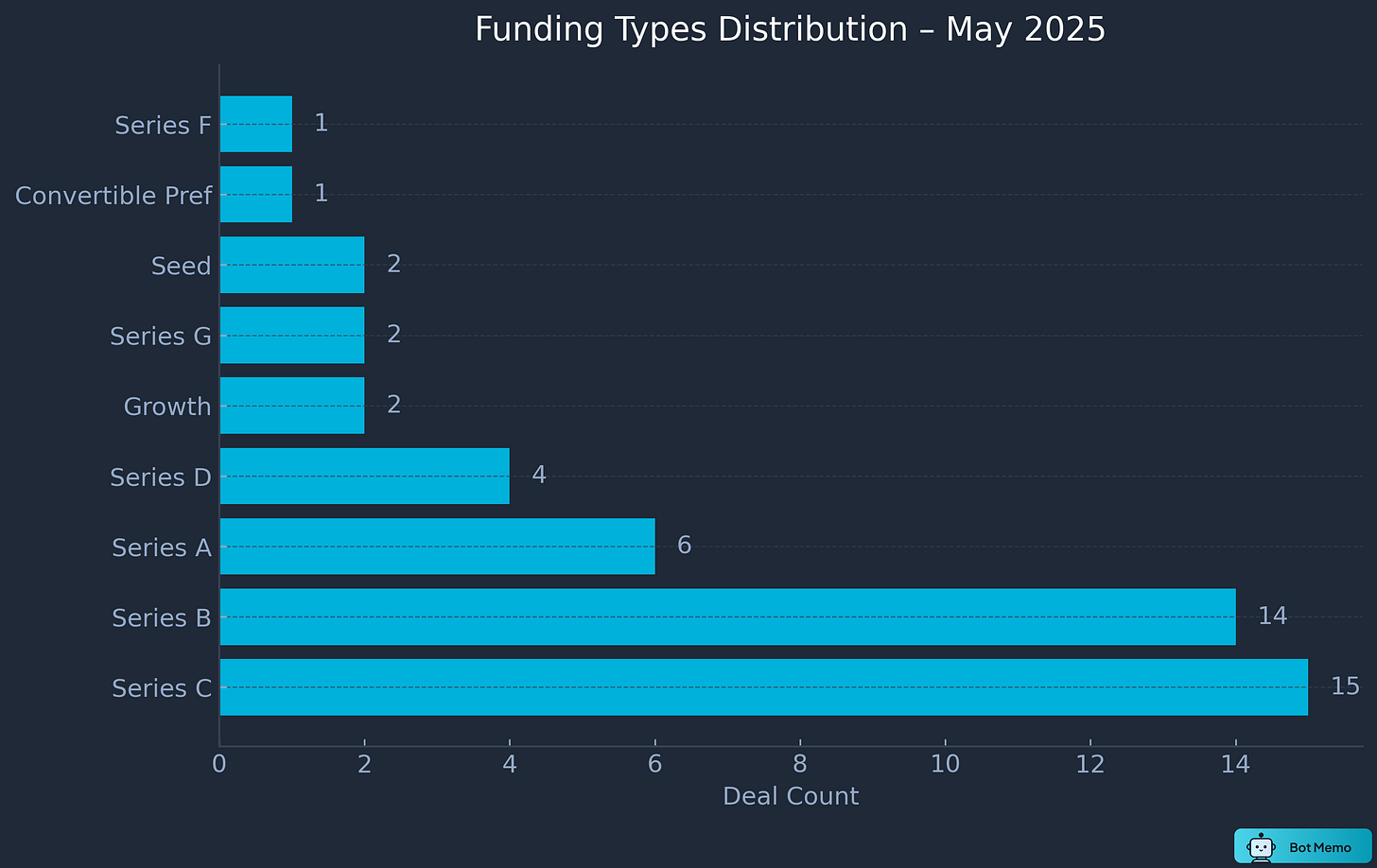

No Surprises in Funding Types?

At the $50M+ level, Series C dominates. No surprises.

But what’s fascinating is that even at the seed stage, AI startups like LMArena—essentially a global community of AI models—raised $100M at a staggering $600M valuation. Atlas Data Storage, touted to “meet the data storage demand of the AI era,” went a step further, raising $155M.

When seed rounds look like Series B rounds, you know it’s just AI things.

Here’s a breakdown of the top funding types:

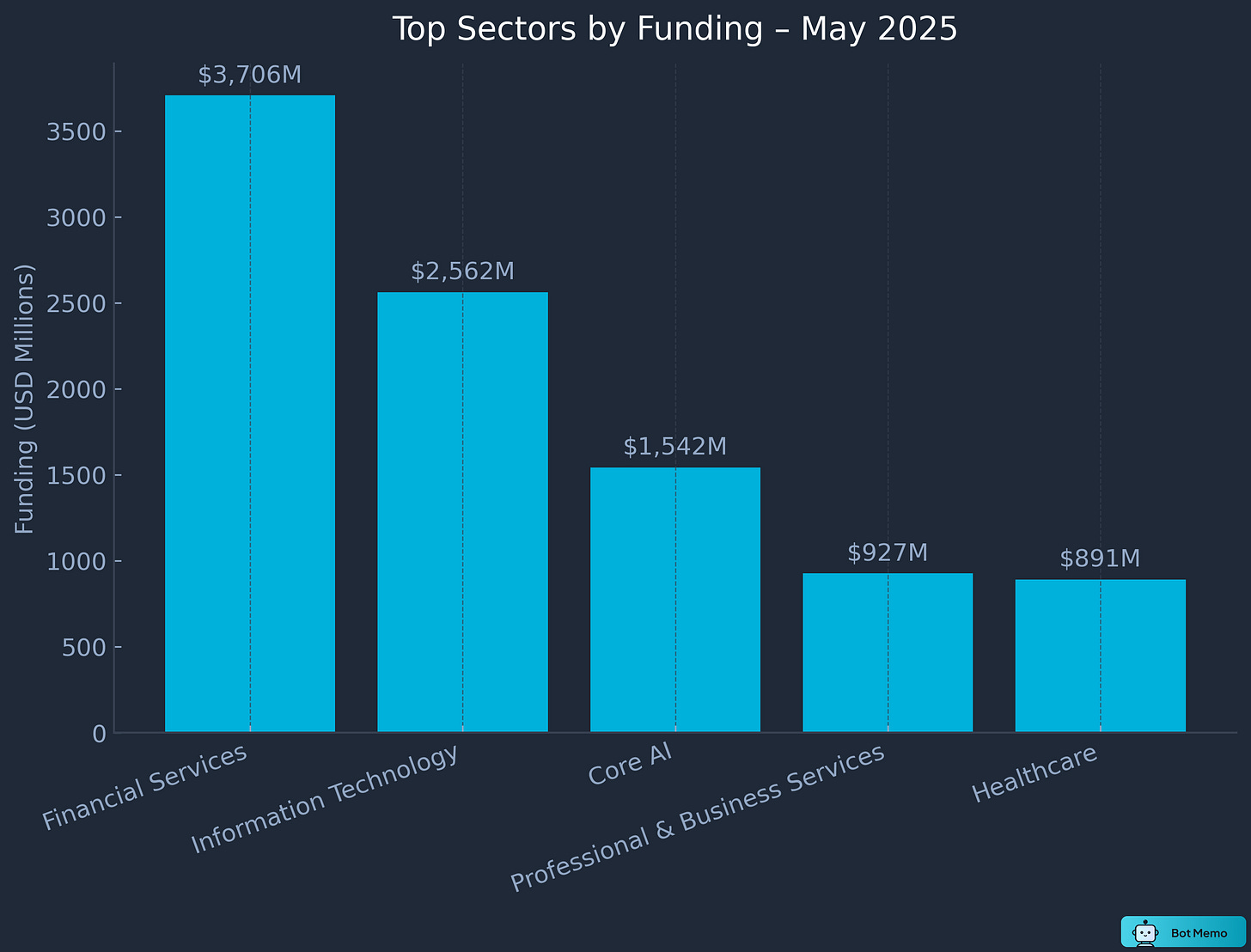

Financial Services Grabbed One-Third of May’s Capital

At $3.7B, financial tech companies pulled in 1/3rd of all capital in our database of companies that raised over $50M.

The geographic spread is real nice in this sector. Personal finance like Wagestream (employee financial wellbeing) and Zopa digital bank from London. Global payments platforms like Singapore-based Airwallex.

Core AI infrastructure (data, ML tooling, cloud) couldn't be left behind. Information technology and core AI infrastructure rounded out the top three sectors.

Here’s a breakdown of our top five sectors:

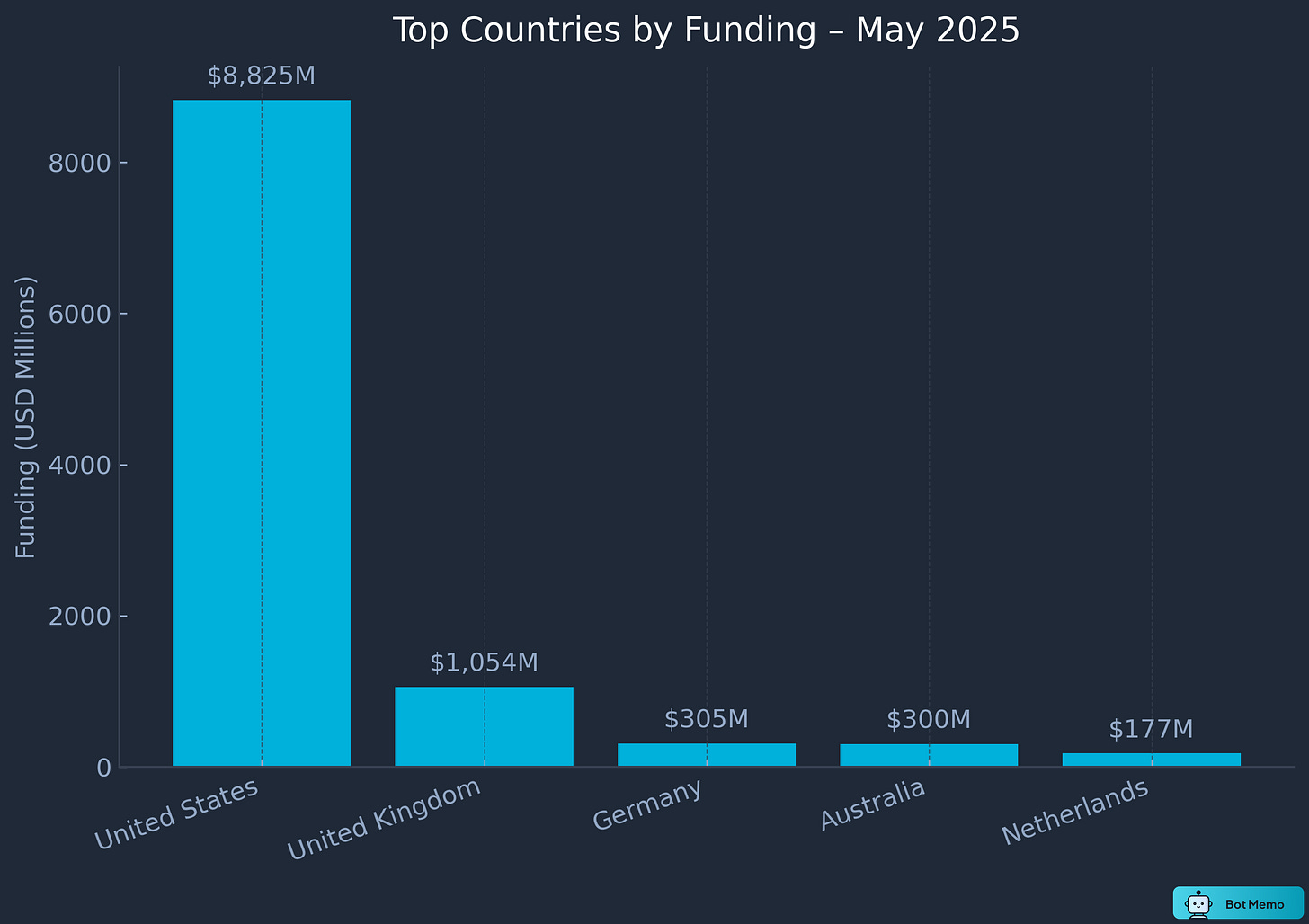

Geographical Snapshot Shows US Dominates

The US retained 80 % of the funding, but the UK punched above its weight. Here are the other top countries:

United Kingdom – $1.05 billion, led by London’s Dojo ($190 million) and Wagestream (£300 million equivalent)

Germany – $305 million, boosted by industrial and healthcare AI plays

Australia – $300 million thanks to Airwallex’s cross-border payments round

Smaller, single-deal totals came from the Netherlands, Israel, Norway, and France

If we talk about the top cities, San Francisco alone gobbled up 28.2% of the funding capital. But beyond the coasts, we had New York, Dallas, Chicago, Los Angeles, and Lehi all made the top 10.

30 “High-Conviction” VCs Double-Down on Mega-Rounds

Thirty investors wrote at least two big checks, showing real conviction in the current market leaders.

General Catalyst flexed with eight mega rounds, backing Grammarly’s global expansion and Chaos Industries’ defense tech

Accel kept pace across fintech (Acrisure) and defense (Chaos), proving a multi-sector appetite

Index, YC, and a16z spread chips widely but at smaller ticket sizes

The AI Funding Reality Check

Investors prefer companies that already sell useful products, handle valuable data, or operate vital infrastructure. Being useful with writing, coding, risk analysis, or database speed beats being flashy. (Oh, and of course, have traction that proves your value!)

Which overlooked data moat will create the next unicorn? Reply with your prediction!

That's it for today. I'll be in your inbox again this week with last week's funding dashboard, and I'll try to send it every week from now on.

I think it’s interesting to see that the money is following data. This is a very good insight for someone like me planing to democratize data in My country.

I love this concept of "data moats". I think this will probably be the single point of differentiation for any AI venture, as features / products become commoditized.

What do you think Chintan?