Hey,

Before we dive into March’s pre-seed startups, a couple of updates:

🏠 Our new home: I’ve moved Bot Memo to Substack, where a lot of the AI and VC community already hangs out. I’m excited to engage with you in the comments.

⏳ Where I have been: I’ve spent the last few weeks revamping Bot Memo’s pipeline that tracks AI funding deal‑by‑deal. I managed to track over 1200 fresh rounds in Q1 2025 alone.

Q1 Funding Trends

I’m kicking off a series of Q1 startup breakdowns, starting with a March 2025 pre-seed list.

These are startups that are exciting to track as they can experience rapid growth. They also reveal the top industries and use cases to pay attention to.

Let’s have a bird’s eye view of the numbers for the 35 AI startups first1:

Total Funding Raised: $66.85 million

Median funding round size: $1.32M

Average funding round size: $1.97M

The top 5 rounds accounted for $26.9M—indicating a minor concentration at the top.

Top Geographies: United States (11 startups) and Europe (18, with the UK leading with 6 and Germany with 3)

Next, I’ve compiled the 35 startups with their funding, websites, LinkedIn, disclosed investors, and locations. Feel free to search for specific geographies too.

Toward the bottom, I share some key visual takeaways on the range of industries and sectors these AI startups are disrupting—and how the geography is affecting the deal sizes.

1) CornerBox

Automated AI retail containers for 24/7 convenience.

Funding: $1M

Lead/Other Investors: Not Disclosed

Website: cornerbox.ai

LinkedIn: CornerBoxAI

Location: Rotterdam, Netherlands

2) DeepScout

Competitive intelligence for e-commerce, monitoring rival pricing & product availability.

Funding: €600K

Lead/Other Investors: Miton

Website: deepscout.ai

LinkedIn: deepscout

Location: Třebíč, Czech Republic

3) experial

AI-powered “digital twins” for real-time customer feedback & market research.

Funding: €2M

Lead/Other Investors: Capnamic, Fressnapf, xdeck

Website: experial.ai

LinkedIn: experial

Location: Köln, Germany

4) Quack

B2B cold-calling platform to streamline sales outreach and analytics.

Funding: $500K

Lead/Other Investors: Metiquity Ventures, Bryan Slauko

Website: quack.so

LinkedIn: quackdials

Location: Calgary, Canada

5) Neural Defend

Deepfake detection & cybersecurity to protect against AI-driven fraud.

Funding: $600K

Lead/Other Investors: Inflection Point Ventures, MIT SBXI, Techstars SF, Soonicorn Ventures

Website: neuraldefend.com

LinkedIn: neural-defend

Location: San Francisco, United States

6) Paid

Billing infrastructure for AI agents and agentic products.

Funding: $11M

Lead/Other Investors: Sequoia, GTMFund, EQT Ventures

Website: paid.ai

LinkedIn: paid-ai

Location: London, United Kingdom

7) Tarta Labs

Web3-integrated anime ARPG bridging gaming, blockchain, and generative AI.

Funding: $4.5M

Lead/Other Investors: BITKRAFT Ventures, The Spartan Group, IVC, HashKey Capital, Gam3Girl Ventures

Website: spotzero.tartagames.com

LinkedIn: tarta-games

Location: Singapore

8) Differential Bio

AI platform for microbial bioprocess optimization in biotech & biomanufacturing.

Funding: €2M

Lead/Other Investors: Ananda Impact Ventures, ReGen Ventures, Carbon13, Climate Capital, Better Ventures, CDTM Ventures

Website: differential.bio

LinkedIn: differential-bio

Location: Munich, Germany

9) Vouchsafe

Flexible KYC platform for users without traditional ID, tackling “ID poverty.”

Funding: £1M

Lead/Other Investors: Bethnal Green Ventures, Biometric Ventures, Fuel Ventures, Seed X, Andrew Chevis (angel)

Website: vouchsafe.id

LinkedIn: vouchsafe

Location: London, United Kingdom

10) Catchwise

AI-based catch prediction for a more efficient & sustainable fishing industry.

Funding: €1.25M

Lead/Other Investors: Dreamcraft Ventures, Sondo, Ocean Impact

Website: catchwise.no

LinkedIn: catchwise

Location: Oslo, Norway

11) Warren

Financial wellness platform for workplace benefits & pension optimization.

Funding: €3M

Lead/Other Investors: Motive Ventures, Entourage, Syndicate One, Pitchdrive, 1105, Business Angels

Website: warren.be

LinkedIn: joinwarren

Location: Ghent, Belgium

12) peopleIX

Unified people analytics platform for HR insights & workforce optimization.

Funding: €2.3M

Lead/Other Investors: Earlybird-X, neoteq ventures, TS Ventures, HRtech business angels

Website: peopleix.com

LinkedIn: peopleix

Location: Cologne, Germany

13) Qlarifi

Real-time BNPL credit data infrastructure for faster & safer underwriting.

Funding: £1.4M

Lead/Other Investors: HoneyComb Asset Management, Carthona Capital

Website: qlarifi.com

LinkedIn: qlarifi

Location: London, United Kingdom

14) Manifest

Tokenized real estate platform bringing U.S. home equity on-chain via DeFi.

Funding: $2.5M

Lead/Other Investors: VanEck Ventures, Lattice Fund

Website: manifest.finance

LinkedIn: manifest-finance-hq

Location: San Francisco, United States

15) Hunted Labs

AI-powered cybersecurity to protect software supply chains at the code level.

Funding: $3M

Lead/Other Investors: Red Cell Partners

Website: huntedlabs.com

LinkedIn: hunted-labs

Location: Los Angeles, United States

16) CaseBlink

AI assistant for business immigration cases, automating legal brief & evidence prep.

Funding: $2M

Lead/Other Investors: Tower Research Ventures, Fakhoury Global Immigration

Website: caseblink.com

LinkedIn: caseblink

Location: New York, United States

17) VISOID

AI-powered rendering software for architects—photo-realistic visuals in seconds.

Funding: €700K

Lead/Other Investors: StartupLab, Antler, OBOS

Website: visoid.com

LinkedIn: visoid

Location: Oslo, Norway

18) ReactWise

AI co-pilot for chemical process optimization in drug & advanced materials R&D.

Funding: $3.4M

Lead/Other Investors: (YC-backed), Y Combinator, Innovate UK Grant

Website: reactwise.com

LinkedIn: reactwise

Location: London, United Kingdom

19) Homeostasis

Carbon-to-graphite reactors for battery-grade materials, turning CO₂ into critical resources.

Funding: $1.2M

Lead/Other Investors: Kayak Ventures, Shakopee Mdewakanton Sioux Community

Website: homeostasis.earth

LinkedIn: homeostasis-systems

Location: Tacoma, United States

20) Flowing Bee

AI-based marketing platform combining behavioral science with content creation.

Funding: $1.6M

Lead/Other Investors: Archangel Ventures, University of Melbourne Genesis Fund, Antler, Alice Anderson Fund, M8 Ventures

Website: flowingbee.com

LinkedIn: flowingbee

Location: Melbourne, Australia

21) Merx

Conversational commerce platform for two-way brand engagement via AI agents.

Funding: €1.1M

Lead/Other Investors: VentureFriends, Ascension

Website: hellomerx.com

LinkedIn: hellomerx

Location: London, United Kingdom

22) Breaker

AI robotics software bringing human-level autonomy to cross-domain robotic missions.

Funding: $2M

Lead/Other Investors: Main Sequence

Website: breakerindustries.com

LinkedIn: breaker-industries

Location: Sydney, Australia

23) OVIANTA

AI medical assistant automating real-time documentation & clinical decision support.

Funding: €540K

Lead/Other Investors: First Drop, Itnig, Encomenda

Website: ovianta.com

LinkedIn: ovianta

Location: Barcelona, Spain

24) Jaipur Robotics

Computer vision platform optimizing waste-to-energy plants for safety & efficiency.

Funding: €725K

Lead/Other Investors: TiVentures SA

Website: jaipurrobotics.com

LinkedIn: jaipurrobotics

Location: Lugano, Switzerland

25) MoirAI Cloud

AI-native infrastructure reducing energy consumption in data centers via real-time optimization.

Funding: $1M

Lead/Other Investors: Not Disclosed

Website: moiraicloud.ai

LinkedIn: moirai-cloud

Location: St. Petersburg, United States

26) JigsawStack

Developer-friendly SDK of small, task-specific AI models for backend automation.

Funding: $1M+

Lead/Other Investors: Not Disclosed

Website: jigsawstack.com

LinkedIn: jigsawstack

Location: San Francisco, United States

27) Wavv

Generative AI music composition platform designed for artists & creators.

Funding: Not Disclosed

Lead/Other Investors: ZD Ventures (ZDVC)

Website: wavv.music

LinkedIn: wavvの

Location: San Francisco, United States

28) GigaCrop

ML-powered seed engineering for higher-yield, drought-tolerant crops.

Funding: $4.5M

Lead/Other Investors: Playground Global, Juniper Ventures

Website: gigacrop.com

LinkedIn: 65659753

Location: Berkeley, United States

29) Loopia

Conversational AI automating customer support for marketplace sellers.

Funding: $650K

Lead/Other Investors: Espírito Santo’s Sovereign Fund, Ace Ventures, BVC, Questum

Website: loopia.com.br

LinkedIn: loopiabr

Location: Brusque, Brazil

30) Alfa

Conversational AI recruiter automating candidate screening & video interviews globally.

Funding: £495K

Lead/Other Investors: SFC Capital, Davide Serra, Rob Kniaz, Chris Adelsbach

Website: welovealfa.com

LinkedIn: alfatechnologyrecruitment

Location: London, United Kingdom

31) Platter

Shopify storefront & checkout optimization to boost conversions & AOV.

Funding: $1.6M

Lead/Other Investors: Animal Capital, Visionary Ventures, Ben Jabbawy, Kyle Hency, Aaron Spivak, Pierson Krass

Website: platter.com

LinkedIn: getplatter

Location: New York, United States

32) TakeMe2Space

Open-access AI satellite infrastructure in low Earth orbit for educators & enterprises.

Funding: Rs 5.5 Crore

Lead/Other Investors: Seafund, Blume Ventures, Artha Venture Fund, AC Ventures

Website: tm2.space

LinkedIn: tm2space

Location: Hyderabad, India

33) Lantern Finance

Crypto lending platform offering overcollateralized, non-custodial loans backed by digital assets.

Funding: $1M+

Lead/Other Investors: Orange DAO, Supermoon Ventures, Andover Ventures

Website: lantern.finance

LinkedIn: lantern-fi

Location: Las Vegas, United States

34) Lemni

AI agent infrastructure for automating customer operations across email, chat, CRM, & more.

Funding: $3.5M

Lead/Other Investors: Sequoia Capital, Designer Fund, Frank Slootman, Scott Belsky, Arthur Mensch, Koen Bok, Jorn van Dijk, Christian Reber, Niklas Jansen, Mario Götze

Website: lemni.com

LinkedIn: lemni

Location: Amsterdam, Netherlands

35) Avery

AI-driven hiring platform automating job design, matching, & interview kits.

Funding: €300K

Lead/Other Investors: Builders Startup Studio

Website: getavery.ai

LinkedIn: getavery

Location: Rotterdam, Netherlands

Emerging Trends in AI Pre-Seed Funding

While for 23 startups the cheques ranged from $1M to $5M, surprisingly, the UK leads in the total funding, driven by Paid’s $11M round. The United States isn’t far behind, though.

In terms of sectors, Core AI continues to garner the most funding. But the application layer has also picked up, as expected, with finance and professional & business services sectors doing well.

In Europe, specifically, there’s a huge focus on Environment and Sustainability, Agriculure, and Energy sectors.

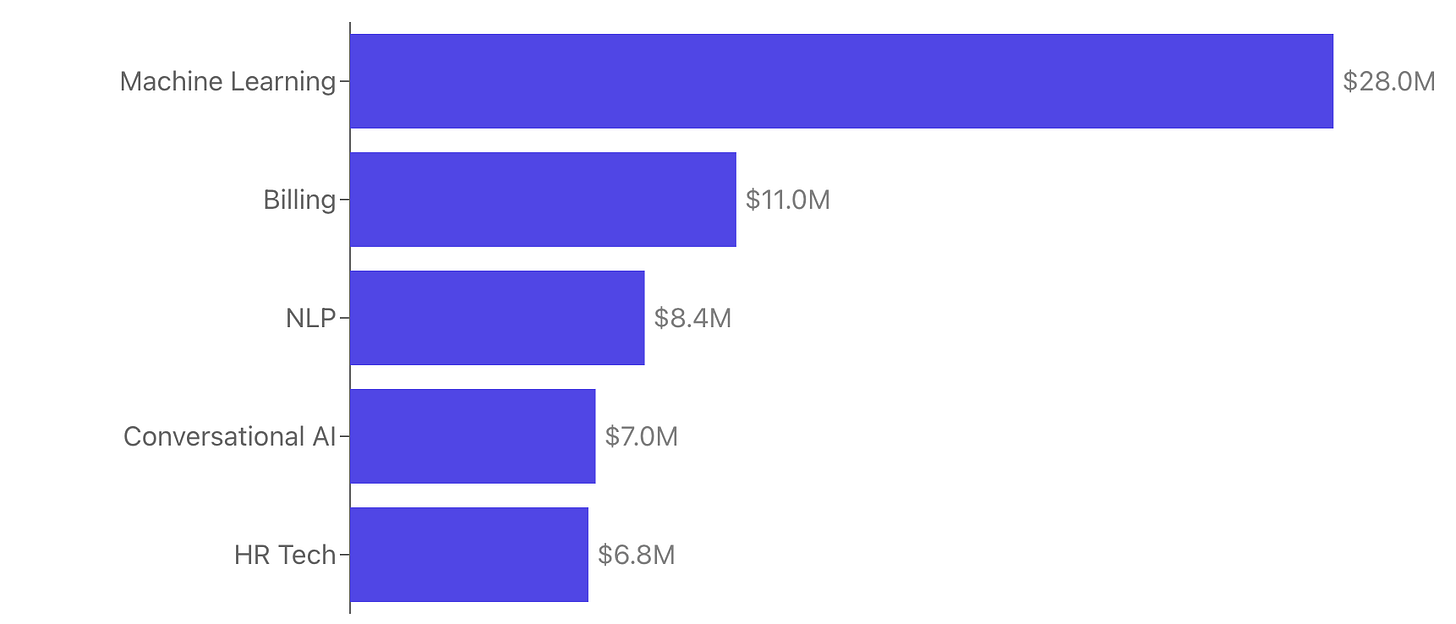

In line with the sectors we saw, the top industries include likes of machine learning, NLP and conversational AI.

And I also like to classify startups at a more granular level than sectors and industries—calling it a segment. Given the buzzword for 2025, no surprises for guessing which segment dominates:

What’s crazy is that the AI hype seems to have highly fragmented the pre-seed investor landscape. There are 99 unique investors, with just Antler and Sequoia appearing twice as repeat investors.

Wrapping Up

And that’s all of the 35 AI startups that raised pre-seed in March 2025. The funding sizes that just the AI tag continues to draw—even at such a nascent stage—continue to surprise me.

Without uttering the h word myself, I would love to quote Sangeet from his terrific post on its strategic value:

Today, hype is a coordination mechanism - to build the momentum required across a system of complements for the system to take off.

Assumptions:

One round stated funding as $1M+ and one as not disclosed.

The analysis is based on 33 disclosed and clearly quantifiable rounds

The assumed currency conversions are:

1 USD = 0.91 EUR

1 USD = 0.78 GBP

1 USD = 86.04 INR

Great post man!