🗽 NYC AI Funding Crushed Silicon Valley Last Week

While SF Chases AGI, NYC is Focused on ROI

Hey,

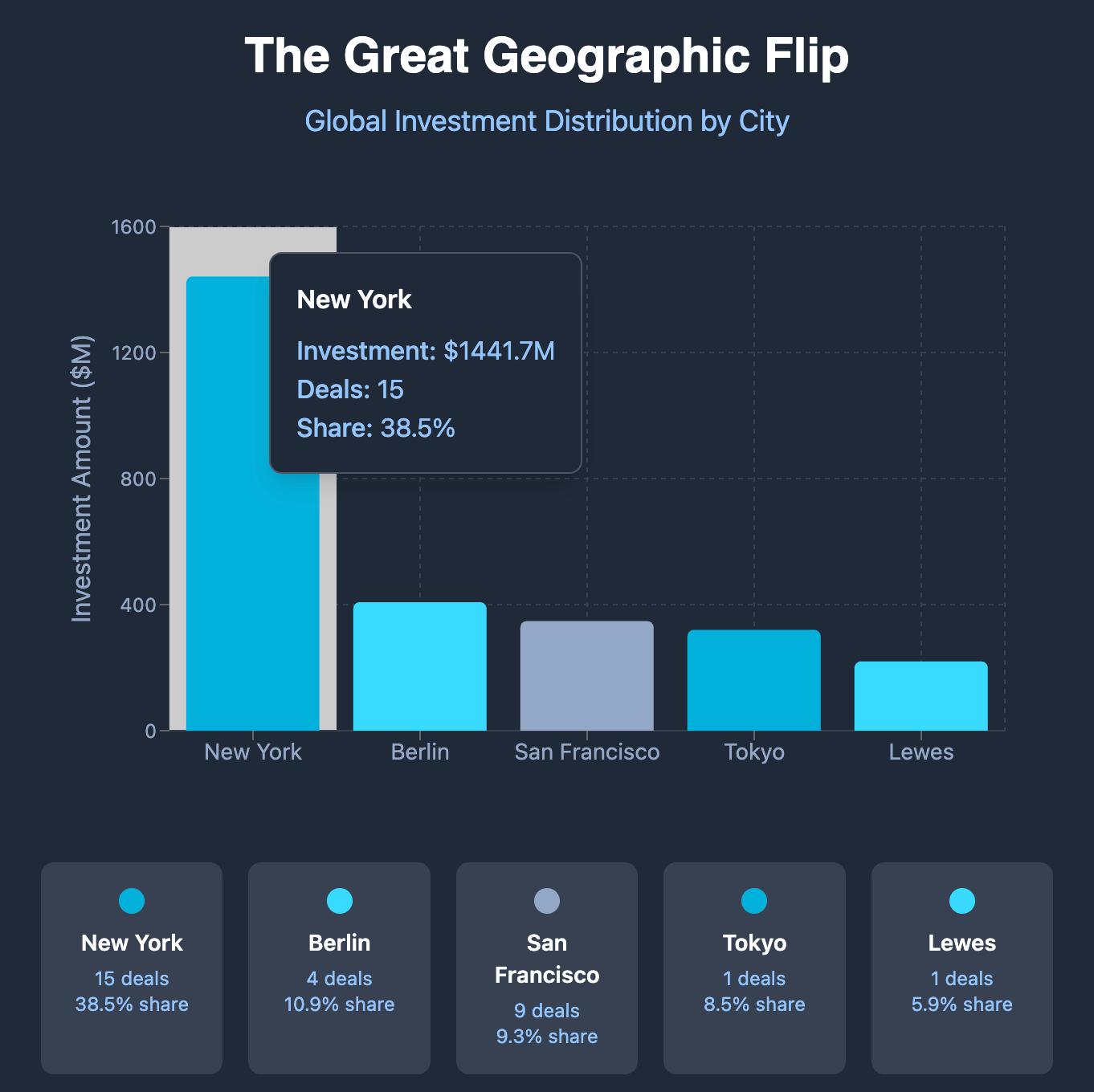

Last week, Bay Area AI startups pulled in a respectable $448M.

But New York crushed’em with a staggering $1.44 billion in funding.

📊 Last Week’s Market Pulse

The real gold lies in the application layer, VCs keep saying.

New York is feelin’ it alright.

They're solving old, hard, profitable problems, and the world's smartest money is taking notice.

Total Funding: $3.7B across 97 deals

Median Deal Size: $9.0M (a healthy, back-to-earth number)

New York's Share: $1.44B (39% of global funding)

San Francisco's Share: $348M (9% of global funding)

🥱 NYC’s "Boring" AI Ecosystem

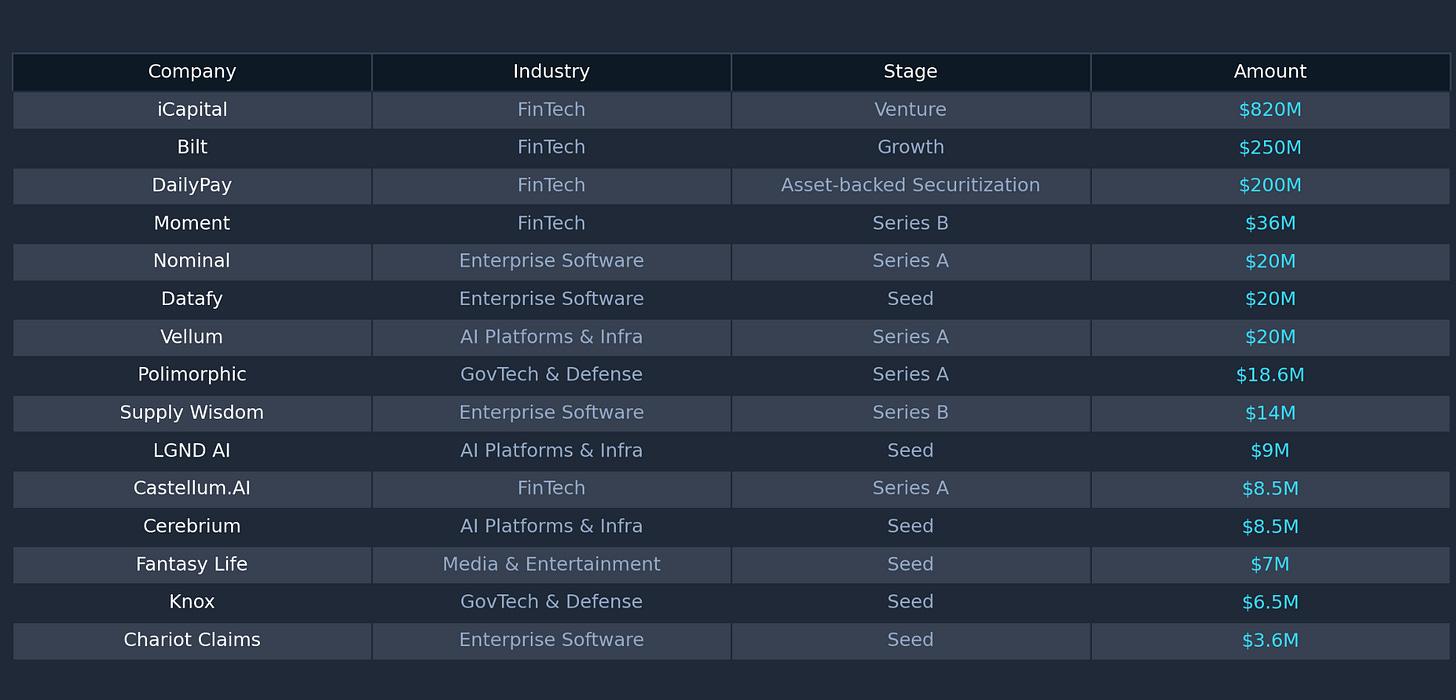

While the headlines were dominated by giants like wealth platform iCapital ($820M) and rent-rewards company Bilt ($250M), the story of NYC's AI scene is centered on applications.

Here are just three of the 15 AI deals that represent the diversity in arguably boring industries and use cases.

For the Enterprise: Nominal ($20M, Series A) is building an AI-powered ERP to automate accounting, a classic "boring" problem with massive market potential.

For the Government: Knox ($6.5M, Seed) is using AI to help federal agencies streamline cloud compliance, a highly specialized and defensible niche.

For the Builders: Vellum ($20M, Series A) is creating an AI workflow platform to help enterprises ship reliable AI solutions.

From Seed to Growth, from FinTech to GovTech, New York is firing on all cylinders.

🍏 VCs Are Planting Their Flags at The Big Apple

Here’s the most critical signal: NYC isn’t raising just local money. The world's most active, top-tier VCs are fueling this trend.

Last week:

General Catalyst led rounds in both a growth-stage giant (Bilt, loyalty program and payment platform) and a Series A startup (Polimorphic, AI to digitize resident services for local governments),

Bessemer Venture Partners led a seed round (Datafy, an autonomous storage optimization startup),

Index Ventures led a Series B (Moment, a company automating trading and portfolio management workflows).

It seems like a coordinated move by the world's elite investors to plant flags across the entire NYC ecosystem.

💡 What NYC’s Success Means

NYC’s playbook shows us the following broader AI trends.

The biggest AI opportunities are likely to be found within "boring” companies in legacy industries such as finance, insurance, and logistics. The question is no longer "What can AI do?" but "What valuable problem can AI solve?"

Geographic arbitrage is real. While SF deals at crazy valuations continue, NYC startups are building sustainable businesses at more reasonable prices.

A city's strategy is a tell. New York recently approved a $40 million investment in the Empire AI Beta supercomputer. Their goal is to democratize advanced computing for applied AI pilots across finance, healthcare, and logistics. If you’re building an AI company, explore the region's AI strategy.

What's your take on NYC's AI boom? Hit reply and let me know your thoughts.

Wow, this is such a sharp snapshot of how the AI funding landscape is evolving, Chintan! Nominal and Knox are great examples of startups choosing depth over dazzle - deep industry problems, strong defensibility.

Great breakdown Chintan. NYC’s focus on practical AI with clear ROI is clearly resonating with top-tier investors. “Boring” problems often yield the biggest wins—especially when tackled with smart, applied AI.