Hey,

They say you can build from anywhere in the world. AI has democratized access to tech, talent can work remotely, and geography shouldn't matter.

Here's the reality check: Last week alone, San Francisco captured $2.8B of the $5.7B raised globally in AI funding. That's 49% of all AI investment.

📊 Last Week’s Market Pulse

Last week (June 23-29), AI startups raised $5.7B across 114 deals

The average deal size was $50.3M, while the median stood at $13M—classic barbell distribution, showing how polarized AI funding has become.

But the weird thing is that geographic concentration keeps accelerating.

Below is a look at a few of the top deals for the week:

1. Thinking Machines - $2B at seed stage, $10B valuation without a product.

Begs the question:

2. Takanock - $500M for renewable energy AI, backed by ArcLight Capital and DigitalBridge.

3. Harvey AI & Abridge - $300M each in legal and healthcare AI, respectively.

While SF dominates in pure AI infrastructure plays, specialized vertical AI companies are securing major funding regardless of location.

🔥 San Francisco is Just Winnin’

Why is that?

Three main reasons:

1. Investor Concentration: Andreessen Horowitz deployed $2.4B across four deals last week alone. When a16z, Accel ($2.2B deployed), and General Catalyst are all writing massive checks from the same 50-mile radius, proximity matters.

Here’s a look at the top investors with the most momentum1 last week:

2. Stage Inflation: SF startups are raising seed rounds that would have been Series B elsewhere. The $93M average seed round (vs. $6.15M median) shows how SF AI startups access different capital rules entirely.

3. Network Density: Menlo Ventures appeared in 8 different co-investment relationships last week (including with NEA, 8VC, and multiple operator-investors). That level of interconnectedness creates deal flow advantages you can't replicate remotely.

Meanwhile:

Europe combined raised less than $500M

Asia (excluding Israel) managed under $250M

The global "anywhere" economy is concentrating faster than ever.

🏭 Domain Expertise > Zip Code

There's one bright spot in this geographic story: vertical AI is starting to break out.

Healthcare and legal AI (Abridge, Harvey) command huge valuations regardless of location because domain expertise matters more than pure tech talent. When you're solving cancer diagnosis or legal workflows, being close to customers trumps being close to Sand Hill Road.

This creates the biggest opportunity I see: vertical AI companies can win from anywhere, but they need to move fast before SF giants notice.

💡What This Means for You

If you're building AI infrastructure: Geography matters enormously. SF proximity gives you access to capital, talent, and customer networks you can't replicate elsewhere.

But AI geopolitics will lead us to more AI infrastructure players getting huge funding from across the world.

If you're building vertical AI: Location arbitrage is your secret weapon. Build where your customers are, hire talent at less than half of SF costs, then compete on domain expertise rather than capital efficiency.

Scout Non-SF: The next wave of outliers will likely come from overlooked verticals in non-SF locations. The data shows VCs are still overpaying for SF proximity in pure infrastructure plays.

Which matters more for AI startups: proximity to capital or proximity to customers? Let me know in the comments below.

Before you leave, I would love your feedback.

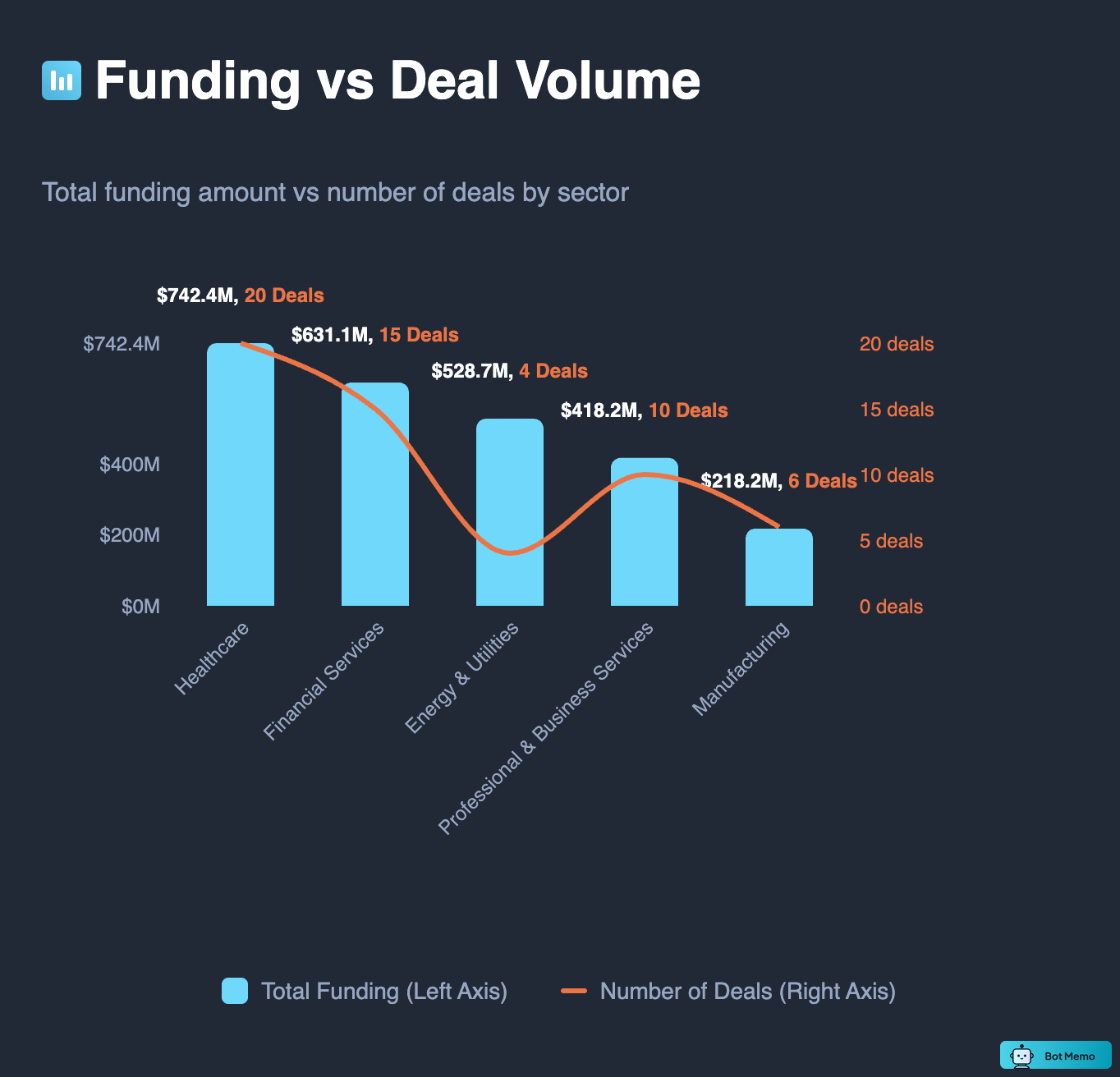

📋 Quick Note on How I Track AI Companies: Using my daily tracking system at Bot Memo, I track startup funding rounds and classify them across 20 sectors, 100+ industries, and dozens of niche segments.

Here’s How the Investor Momentum Score is Calculated: The score helps identify which VCs are most active and influential each week by combining three key factors:

Deal Activity (40%): How many deals they're doing compared to market leaders (5+ deals = high activity)

Check Size (40%): Whether they're writing bigger checks than the market average

Stage Diversity (20%): How many different funding stages they invest across (seed, Series A, B, etc.)

The score runs from 0-2.0, where 1.0+ indicates high momentum. For example, Andreessen Horowitz scored 1.25 last week with four deals, $600M average check size, and investments across three different stages.

Thank you for cutting through the “build from anywhere” myth with actual numbers. It’s wild how much the AI gold rush is still tethered to geography, despite all the remote work and democratized tools we hear about. The $93M “seed” rounds in SF honestly sound surreal.

Thanks for sharing. The Funding Risk for Existing Portfolios is Growing Rapidly!