💥 The 7 AI Trends That Exploded Over 250% in Q2

Where smart VC money is going beyond foundation models

Hey,

AI agents were earmarked as a major trend for 2025.

But what are the specific micro trends and niches that VCs are investing heavily into?

I analyzed 2,400+ AI startups from H1 2025, breaking down the trends that grew from Q2 vs. Q1 (analysis methodology here)1

Before we begin, I have a question for you.

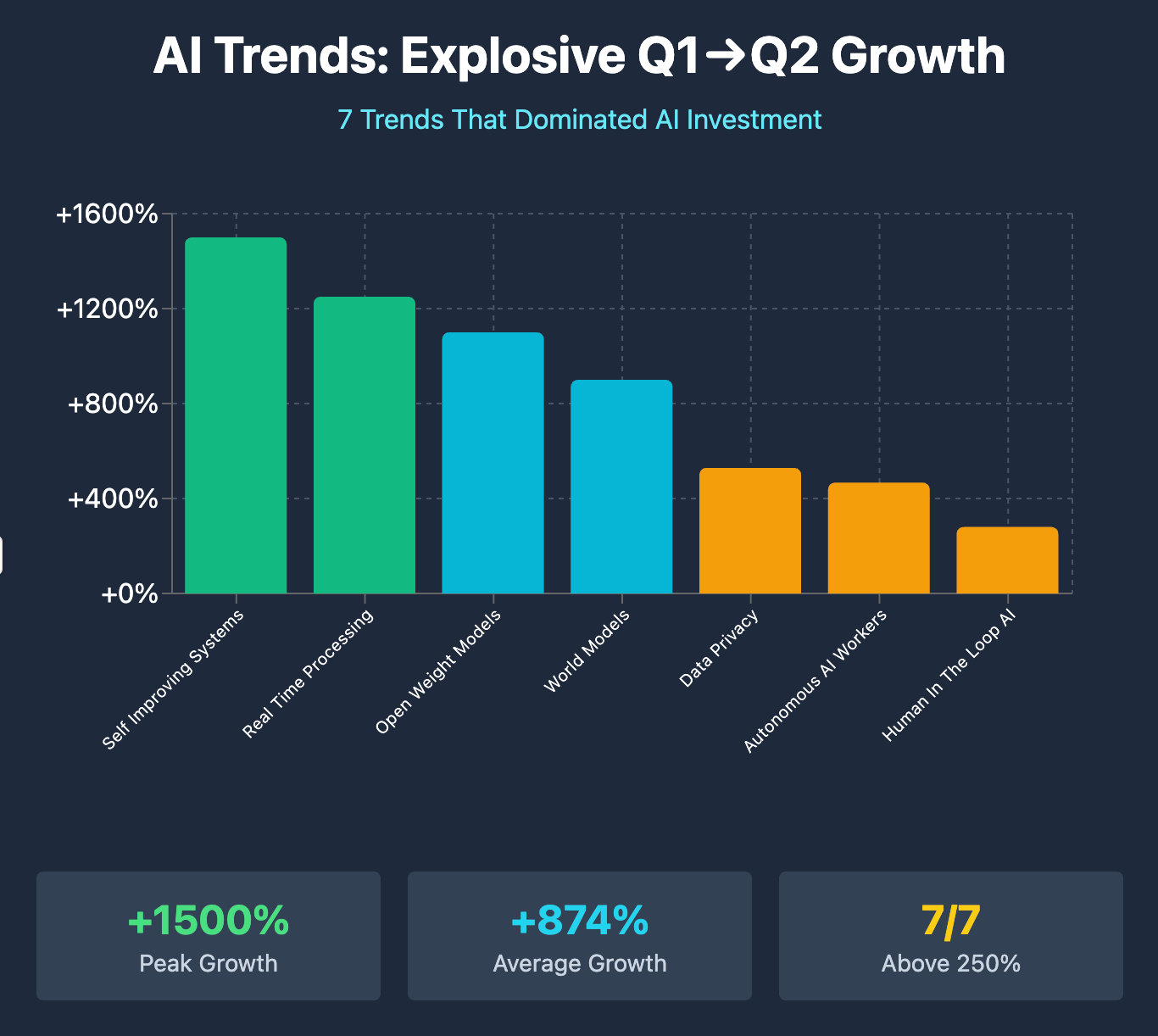

Now before I share every trend that exploded in Q2, here’s a quick look at all the seven:

♻️ 1. Self Improving Systems: +1,500% Growth

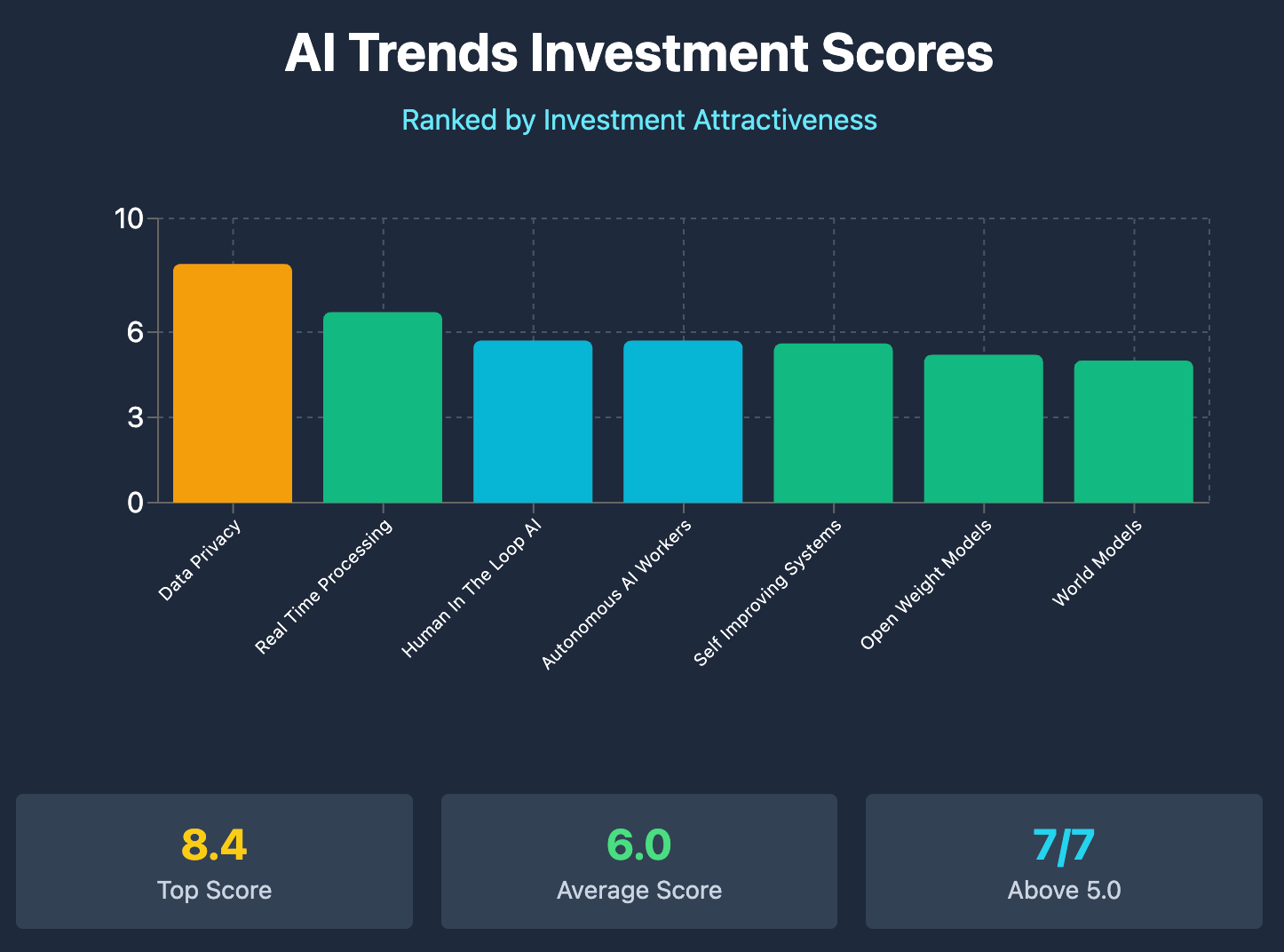

Investment Score: 5.6 | 24 Companies | $298.2M Total Funding

AI systems that adapt autonomously without human intervention. As models get more reasoning capabilities, the ability to self-optimize has become the foundation for true autonomy.

“In an agentic world, the highest leverage asset isn’t a legacy dataset: it’s a feedback loop with real users in a real workflow.

The most resilient AI startups are building systems that continuously learn from real-world interactions, with custom evaluators and reward pipelines that turn messy, judgment-heavy work into a compounding advantage.”

Top Players:

Hypernative ($40M) - Self-adapting security systems

Treefera ($30M) - Forest monitoring that learns from environmental changes

Knowunity ($27M) - A social learning platform that evolves with each student interaction

Why it's exploding: Most enterprise developers are experimenting with AI applications. Self-improvement is the difference between tools that get better and tools that get replaced.

⚡ 2. Real Time Processing: +1,250% Growth

Investment Score: 6.7 | 50 Companies | $686.1M Total Funding

Real-time data processing is fundamental for providing a seamless user experience across diverse sectors such as finance, healthcare, retail, and transportation.

Top Players:

Dataminr ($100M) - Real-time information discovery and alerts

Utilidata ($60.3M) - Grid optimization with millisecond responses

Chalk AI ($50M) - Real-time feature engineering for ML

Why it’s exploding: Enterprise AI dies in batch processing. Customer service needs instant responses, fraud detection needs millisecond alerts, and supply chains need real-time optimization. Speed separates working AI from expensive demos.

🛡️ 3. Data Privacy: +529% Growth

Investment Score: 8.4 | 48 Companies | $1.91B Total Funding

The highest investment score goes to privacy. A major enterprise AI adoption bottleneck is data security, not model capabilities.

With EU regulations tightening and enterprise AI adoption accelerating, data protection has become the foundational requirement for any AI deployment.

Top Players:

Cyera ($540M) - Data security posture management

Abridge ($300M) - Healthcare AI with privacy-first design

Commure ($200M) - Secure healthcare data platforms

Why it dominates: AI agents can access sensitive data, and present huge data privacy as well as security challenges. Indeed, the stringent requirements of GDPR and the EU AI Act highlight the need for privacy-by-design architectures.

🧩 4. Open Weight Models: +1,100% Growth

Investment Score: 5.2 | 12 Companies | $129.5M Total Funding

Open-weight models are geopolitical infrastructure. OpenAI's August 2025 release of GPT-OSS models under the Apache 2.0 license validated this trend after years of close development.

“Open source have geostrategic value because they can become global standards in some areas of business and in academic research worldwide. This focus aims to ensure America has leading open models founded on American values.”

Top Players:

Nous Research ($65M) - Open-source AI lab focused on human-centric simulators

Deep Infra ($18M) - Infrastructure for deploying open models

Parasail ($10M) - Open model optimization tools

Why US companies are rushing to build open-source AI: The US wants to maintain its technological leadership and project its democratic values, counteracting China’s open-source AI push.

🤖 5. Autonomous AI Workers: +467% Growth

Investment Score: 5.7 | 24 Companies | $489.5M Total Funding

Gartner predicts that at least 15% of day-to-day work decisions will be made autonomously through agentic AI by 2028. But people want real automation that actually gets work done, not "agent-washed" chatbots.

Top Players:

Glean ($150M) - Enterprise knowledge worker AI

Maven AGI ($50M) - Enterprise AI agents for customer service

Mandolin ($40M) - AI agent platform for specialty drug access

Reality vs hype: The same report by Gartner I quoted above also points out that 40% of agentic AI projects will be cancelled by the end of 2027. So AI agent startups should be wary of demos promising AI agents that can actually complete workflows without human oversight.

🧠 6. Human-in-the-Loop AI: +280% Growth

Investment Score: 5.7 | 19 Companies | $1.2B Total Funding (excluding Meta's $14.3B Scale AI investment)

Scale AI (Meta purchased a 49% stake in the AI data infrastructure company for $14.3B) and Anysphere (raising $900M for its AI coding tool Cursor) are flag bearers of this trend.

Scale AI has human annotators to “post-train” AI models (the bulk of Scale AI’s revenue comes from providing access to this network of presumably over 100k)

Anysphere believes that the future is a “human-AI programmer”

The funding appears disproportionate due to the above two startups. But other startups are riding the tides of this trend.

Top Players:

Toloka ($72M) -They build and supply high‑quality, expert-verified training, evaluation, and safety data

Centific ($60M) - Domain experts and high-quality datasets to help companies build, train, and safely deploy GenAI systems

Autonomize AI ($28M) - Accountable, human-centered AI augmentation for healthcare

Why we need humans in the loop: Pure AI systems have limitations. Human judgment, creativity, and oversight are essential to building reliable systems and avoiding expensive failures.

🌍 7. World Models: +900% Growth

Investment Score: 5.0 | 10 Companies | $187.9M Total Funding

AI systems that understand their environment are essential for autonomous operation. As agents move beyond chatbots, they need models of how the world actually works.

Top Players:

Hex ($70M) - Data environment modeling and analytics

Samaya AI ($43.5M) - AI agents for Financial Services

Sword Health ($40M) - Physical therapy environment modeling

Why now: Combined with self-improving systems, world models enable AI that can operate independently without constant human correction.

And there we have it! The top seven AI trends that are exploding right now.

Here’s how the investment scores for them line up:

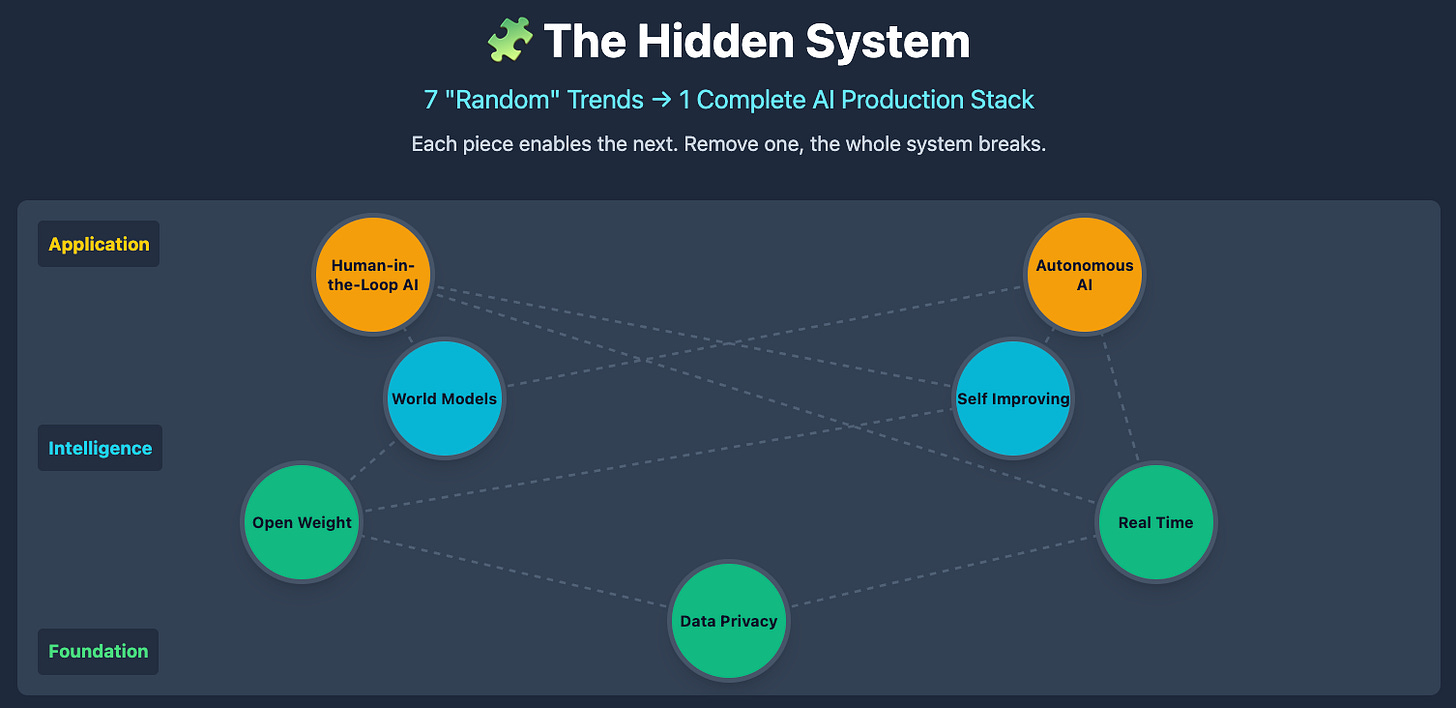

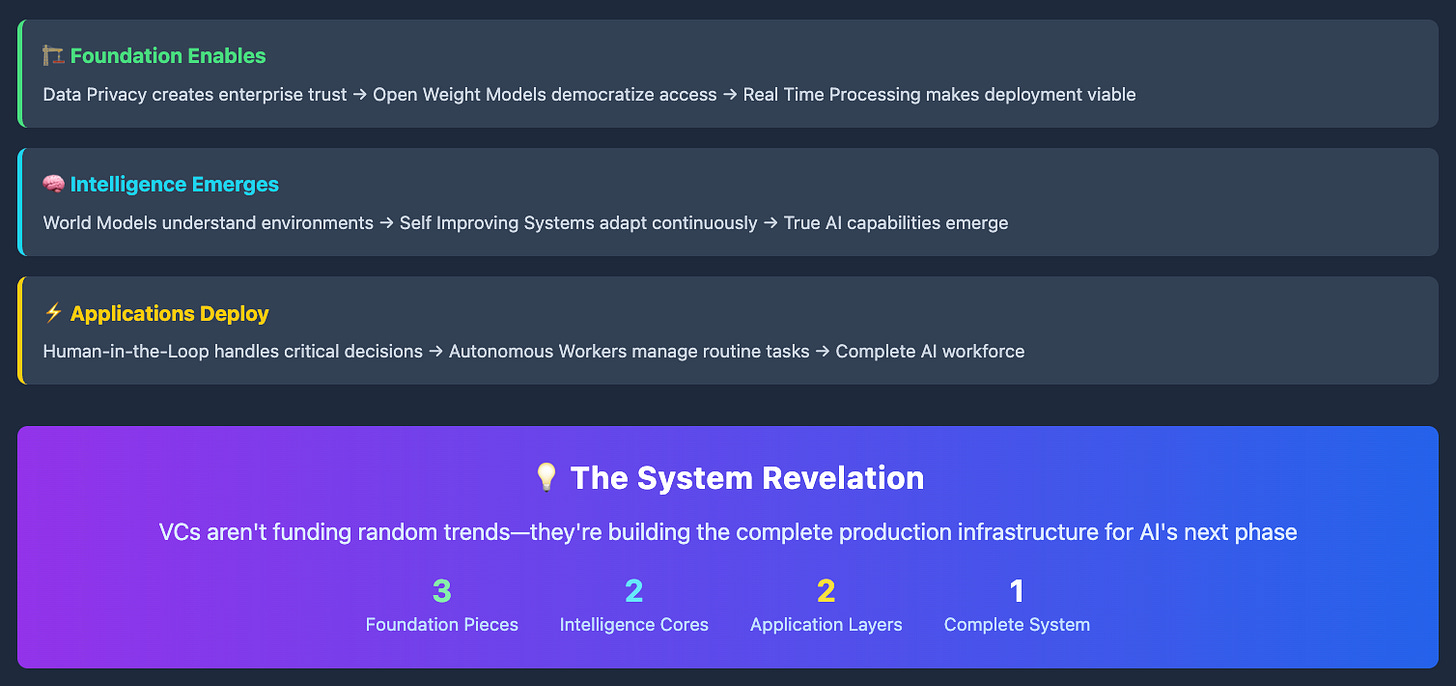

🏗️ How These Trends Build a Complete AI Infrastructure Stack

If we take a bird's-eye view, the complete infrastructure stack is being built from the ground up.

Foundation Layer:

Open Weight Models create the base technology

Data Privacy makes it trustworthy for enterprises

Real Time Processing makes it usable at scale

Intelligence Layer:

World Models provide environmental understanding

Self Improving Systems add continuous adaptation

Application Layer:

Human-in-the-Loop AI for high-stakes decisions

Autonomous AI Workers for routine operations

🔮 Early Signals: What's Next

Beyond the explosive seven, these three trends also show emerging momentum in the Q2 2025 data:

Edge AI Deployment (+200% detection growth): Enabling AI processing directly on devices for lower latency and improved privacy.

Model Compression (+150% detection growth): Making large AI models more efficient for deployment on resource-constrained hardware.

Synthetic Data Generation (+180% detection growth): Creating artificial datasets to train AI models, overcoming data scarcity concerns.

And that’s it for today’s trend breakdown.

Which of these seven trends will produce the next $1B+ round? I would love to hear your prediction.

🧭 Methodology

Analysis Period: Q1 2025 vs Q2 2025 comparison

Data Sources: 2,400+ AI startup funding rounds from Q1 and Q2 2025 Bot Memo data pipeline.

How I Did The Trend Detection: 274 keyword variations across 48 AI trends using case-insensitive, hyphen-flexible exact matching

Growth Calculation: Q1 detected 49 trend instances, Q2 detected 219 instances = 347% growth in trend detection itself.

Investment Scoring: Growth rate + total funding volume + company diversity + market momentum

Categories of Trends: Technical Breakthroughs, Business Model Shifts, Infrastructure/Economics

Company Analysis: Funding amounts and descriptions from Q2 2025 startup announcements

AI Platforms for the enterprise that need forward engineers - big AOVs, entrenched & sticky once live leading to massive spread btw CaC & LTV - see Cogna.co as an example. These will be wildly successful in NON Tech markets which is 95% of global GDP vs Tech which is 5% and overly competitive.

Isn't it interesting that on one hand, startups are racing to build models that learn continuously from real-world data. On the other, privacy-first architectures often restrict the flow of such data for good reasons.

Maybe the next breakout $1B+ company will emerge from those who resolve this paradox ;)