I analyzed 2,400+ AI startup funding deals from Q1 and Q2 2025, hunting for trends that haven't hit the mainstream yet (analysis methodology here1).

While new entrants in the foundation model race now find it challenging to catch up, the infrastructure layer surrounding them remains wide open.

Indeed I found a quiet revolution happening in these five completely new AI tech trends. They have:

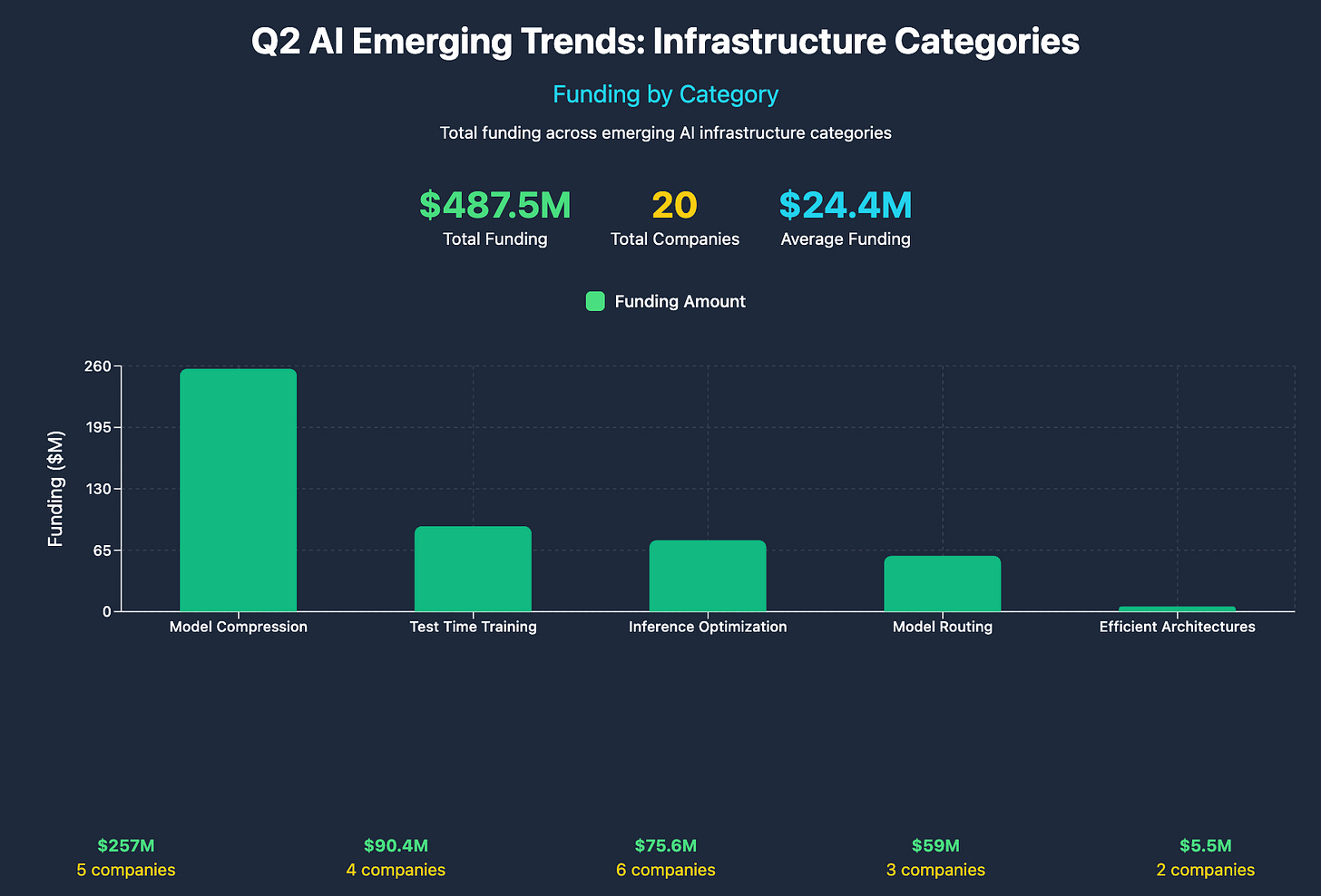

Attracted $487.5M across just 20 startups

Likes of a16z, Greylock, and Khosla Ventures betting on their tech

Average deal size: $24.4M per company

Are completely new in Q2!

Today, I’ll break down these trends.

Before we dive in, I have a quick question:

Okay here are the top eight AI startup funding rounds that are driving these emerging AI trends.

Now let’s look at the first emerging AI trend.

🚀 1. Inference Optimization: $75.6M | 6 Companies

While training models and fine tuning them is important, there’s a strong business case for inference. Such startups enable existing models run faster and cheaper.

Top Players:

Yupp ($33M) - Crowdsourced AI evaluation platform that pays users to compare responses from 500+ AI models, creating valuable training data for optimizing model performance

TheStage AI ($4.5M) - AI optimization platform focused on accelerating model deployment and making neural networks more resource-efficient

Literal Labs ($4.6M) - Logic-based AI technology company that generates AI models faster, more energy efficient, and explainable than neural networks

Why inference matters: Every millisecond of inference speed translates to millions in cost savings at enterprise scale.

🗜️ 2. Model Compression: $257.0M | 5 Companies

The highest funded emerging and one of the fastest growing AI trends. Companies in this industry solve the "how do you run GPT-4 quality models on an iPhone" problem.

Top Players:

Multiverse Computing ($215M) - Quantum-inspired AI company using tensor networks to compress large language models by up to 95% while maintaining performance through their CompactifAI platform

IUNU ($20M) - Agriculture-focused AI company leveraging computer vision and compressed models to optimize greenhouse operations and crop yields

EdgeRunner AI ($12M) - Creates air-gapped, on-device generative AI agents for mission-critical applications using advanced model compression techniques

The compression gold rush: Edge deployment is AI's final frontier. Every smartphone, car, and IoT device needs AI that works without cloud connectivity. Compression unlocks that massive market.

🎯 3. Adaptive AI: $90.4M | 4 Companies

AI systems that continuously learn and adapt to individual users, situations, or data to deliver custom, real-time value.

Top Players:

Speedata ($44M) - Develops custom analytics processing units (APUs) optimized for real-time data analysis and adaptive AI model performance

Toca Football ($35M) - Soccer experience company using AI systems that continuously learn and adapt to individual player performance during training sessions

Pistachio ($7M) - Oslo-based cybersecurity platform using AI to analyze user behavior and learning patterns in real-time to deliver personalized cybersecurity training

Why now: Static models are becoming commoditized. The competitive advantage shifts to personalized systems that continuously adapt to user preferences.

🧭 4. Model Routing: $59.0M | 3 Companies

GPT5’s release has already popularized this concept. It involves smart routing between different AI models based on query complexity: thinking vs instant vs auto vs pro.

Top Players:

Mandolin ($40M) - Healthcare AI automation platform that intelligently routes requests through specialized models to streamline specialty drug access and reduce administrative bottlenecks

Ravenna ($15M) - AI-powered internal help desk platform built natively in Slack, using smart routing to handle IT, HR, and operations requests efficiently

Unbound ($4M) - An AI gateway (observability-rich middleware) enabling IT teams to safely manage and monitor AI model deployments with intelligent routing capabilities

The routing revolution: As model costs vary between providers, intelligent routing becomes a massive cost optimization opportunity.

⚡ 5. Efficient Architectures: $5.5M | 2 Companies

Rather than optimizing existing architectures, these companies design completely new AI systems optimized for specific use cases.

Top Players:

Embedl ($5.5M) - Swedish deeptech startup specializing in AI model optimization for edge deployment. Their SDK delivers significant inference speedup, memory, and energy savings on embedded devices

Vontive ($150M Securitization) - An embedded mortgage platform for real estate investment using custom architectures optimized for credit risk analysis and automated decision-making

The architecture bet: While everyone builds on transformers, breakthrough performance might come from fundamentally different approaches. It may require significant funding, though.

Here’s a quick look at all five major emerging trends in Q2:

🔥 Top VCs Who Are Betting on These Emerging AI Trends

Let’s look at a few of the top VCs betting on these emerging AI trends.

Most Active:

Khosla Ventures - Leading rounds in model routing (Ravenna) and backing multiple optimization startups

Greylock Partners - Doubling down on healthcare AI automation (Mandolin) and enterprise infrastructure

Madrona Ventures - Seattle-focused, backing both compression (EdgeRunner AI) and routing (Ravenna) trends. They had closed a $770M fund in January.

…The fresh capital will be used to invest…in infrastructure companies that “can remove friction” between foundational models and users.

- Matt McIlwain, Madrona Managing Director

Some Notable Angels:

Guillermo Rauch (Vercel CEO) - Was an angel in both Mandolin & Ravenna.

Jerry Yang (Yahoo co-founder) - Was an angel in Mandolin

Wade Foster (Zapier) - Angel in Ravenna

Zain Rizavi - Angel in Unbound

📊 The Real AI Arms Race

If you have a bird’s eye view of the five emerging trends, there’s an intriguing takeaway: 80.3% of the funding ($391.6) went to infrastructure optimization. The VCs are doing their thing to try and make AI actually work at scale.

Of course, San Francisco is home to five of these companies.

Which of these five trends do you think will produce the next unicorn? I would love to know your prediction.

📋 Methodology:

Analysis Period: Q1 vs Q2 2025

Data: 2,400+ AI startup funding rounds from Q1 and Q2 2025 Bot Memo data pipeline

How I Did The Trend Detection: Done on 141 terms; case-insensitive, hyphen-flexible regex; max once per record!

What’s an Emerging Trend: I considered it a NEW trend if Q1 = 0 & Q2 ≥ 5 (drop terms with <5 mentions)

Categories: Technical Breakthroughs, Business Model Shifts, Infrastructure/Economics

Company Analysis: Funding amounts and descriptions from Q2 and Q1 2025 public funding announcements of startups

Limitations: Dictionary detection may undercount new AI concepts or favor companies with explicit tech mentions

Great piece

Fantastic post. Thanks for breaking this down. I think the next unicorn will actually come from a company that can figure out how to help other companies 'retrofit' their use of AI...